In the previous article, the benefits of smoothed bonus portfolios for living annuitants were explored, highlighting their ability to mitigate downside risk during market downturns, as indicated by their improved “Time to Ruin” in the worst 10% of scenarios modelled. This article explores a “best of both worlds” strategy by blending a smoothed bonus and market-linked portfolio within a living annuity construct to balance long-term growth with capital protection.

Overview

This study compares three portfolios: a market-linked portfolio, a partially vesting smoothed bonus portfolio, and a “blended” portfolio consisting of equal allocations to the market-linked and partially vesting smoothed bonus portfolios. Within the blended portfolio, the allocation to the smoothed bonus portfolio will be used to service the monthly income requirement. All portfolios have identical underlying asset allocations of 60% equities, 20% bonds, 10% property, and 10% cash. The investigation used 1 000 randomised scenarios (including returns for each asset class and inflation) to assess the portfolios’ performance over a 30-year retirement period. The statistic used for comparison is Time to Ruin (TTR), which measures how long an annuitant’s capital can sustain inflation-adjusted monthly drawdowns. Drawdown rates start at 6% or 8% per annum and are adjusted annually on the policy anniversary date.

The following risk measures were used to analyse the differences in retirement outcomes:

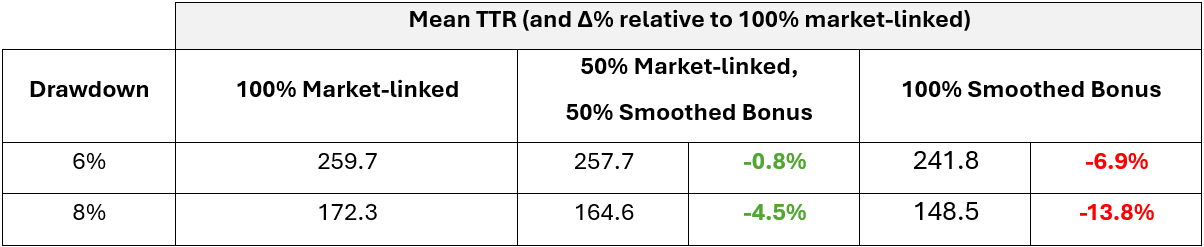

- Mean TTR: This measures the average TTR across all 1 000 simulated scenarios, indicating how long capital is expected to last for on average.

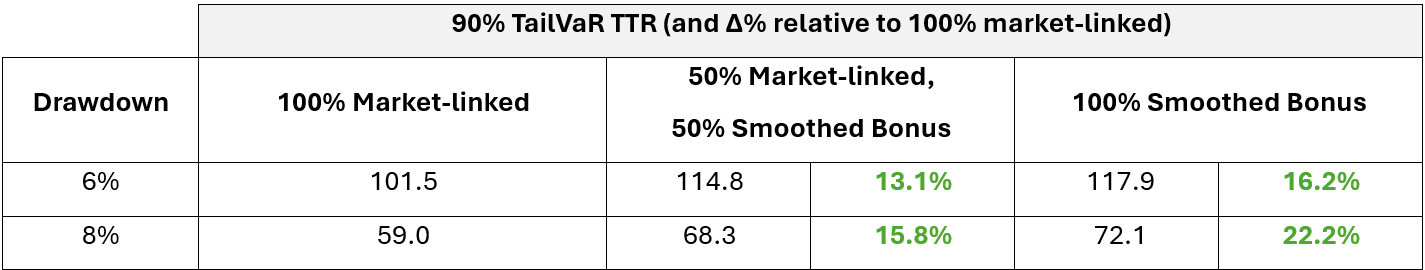

- 90% TailVaR TTR: The tail value at risk (TailVaR) at the 90th percentile measures the average time to ruin for the worst 10% of scenarios. It shows how long capital is expected to last during extreme conditions, such as extended market downturns or unfavourable sequences of returns, and highlights portfolio performance under market stress conditions.

Key Findings from the Modelling Exercise:

1. The blended portfolio is better in keeping up with the market-linked portfolio

On average, the blended portfolio performs more in line with the fully market-linked portfolio than the smoothed bonus portfolio – particularly at higher initial drawdown rates. By using the blended approach, the living annuitant does not significantly sacrifice their net-of-fees return potential when adding protection in the form of a smoothed bonus portfolio, as evident from the improved mean TTR relative to being 100% invested in the smoothed bonus portfolio.

2. The blended portfolio still provides significant protection in tail scenarios

The major advantage of the blended portfolio is that it retains the protection element in tail scenarios, which becomes evident in extreme market conditions, such as those experienced in the worst 10% of scenarios. Although the protection is less than when the annuitant is 100% invested in a smoothed bonus portfolio, it offers a balance between the net-of-fees return potential (as discussed in the previous section) and downside protection. The 90% TailVaR TTR of the blended portfolio compared to being 100% invested in the market-linked portfolio, shows that retirees stand to benefit from the inclusion of a smoothed bonus portfolio, which protects annuitants during market downturns.

Summary

For retirees relying on living annuities for income, blending smoothed bonus and market-linked portfolios offers an effective way to balance stability and growth. This “best of both worlds” strategy provides protection during adverse market conditions without significantly compromising return potential for the living annuitant over the long term.

By allocating a portion of their portfolio to a smoothed bonus investment, retirees can secure their essential expenses, ensuring financial stability despite market volatility. At the same time, the market-linked portion remains focused on growth, helping to sustain real purchasing power for retirees over time. This “best of both worlds” approach also helps mitigate sequence of returns risk, reducing the likelihood of depleting capital too soon in periods of market drawdowns.

Disclaimer: This blog is for general information and education only. It does not constitute advice (financial or otherwise) and should not be relied upon as such. I am not licensed to provide financial advice. The content may contain errors or omissions and is provided without any guarantee of accuracy or completeness. No liability is accepted for any loss or damage arising from reliance on this content. For advice tailored to your circumstances, please consult a registered financial advisor.