The prevailing local and global investment markets are characterised by increased volatility and uncertainty largely arising from sluggish economies, the remnants of the 2022 bear market, and in South Africa persistent loadshedding, logistical and infrastructural issues and being grey listed. This can be a difficult time for retirement fund members, especially those who are very close to retirement, as any financial losses in their retirement savings during this time can have a serious impact on their financial future and their retirement planning. It is therefore crucial that these members carefully consider investment options that not only target inflation beating investment returns, but that also provide some capital protection of their retirement savings against investment market volatility and downturns.

Smoothed Bonus Portfolios

Smoothed bonus portfolios are portfolios that are specifically designed to protect members against excessive investment market volatility and full or partial capital loss. It is during these uncertain times when smoothed bonus portfolios with 100% capital guarantees are particularly valuable as they protect investors from capital loss no matter the market conditions at the time of a policy benefit event (death, disability, resignation, or retirement). This means that members receiving a policy benefit payment when the markets are at a low, would be guaranteed to get 100% of their money that they invested plus any guaranteed bonuses that were declared.

One such a portfolio is the Momentum Smooth-Edge smoothed bonus portfolio. This portfolio provides smoothed inflation-beating returns by utilising an underlying investment portfolio that uses a combination of passive, smart-beta and active investment strategies, while offering capital guarantees and reduced volatility of returns. The cost and benefit of the smoothing features (including the capital guarantee) for this portfolio are illustrated in the next section using the concept of an efficient frontier.

Exploring the Risk-Return Landscape

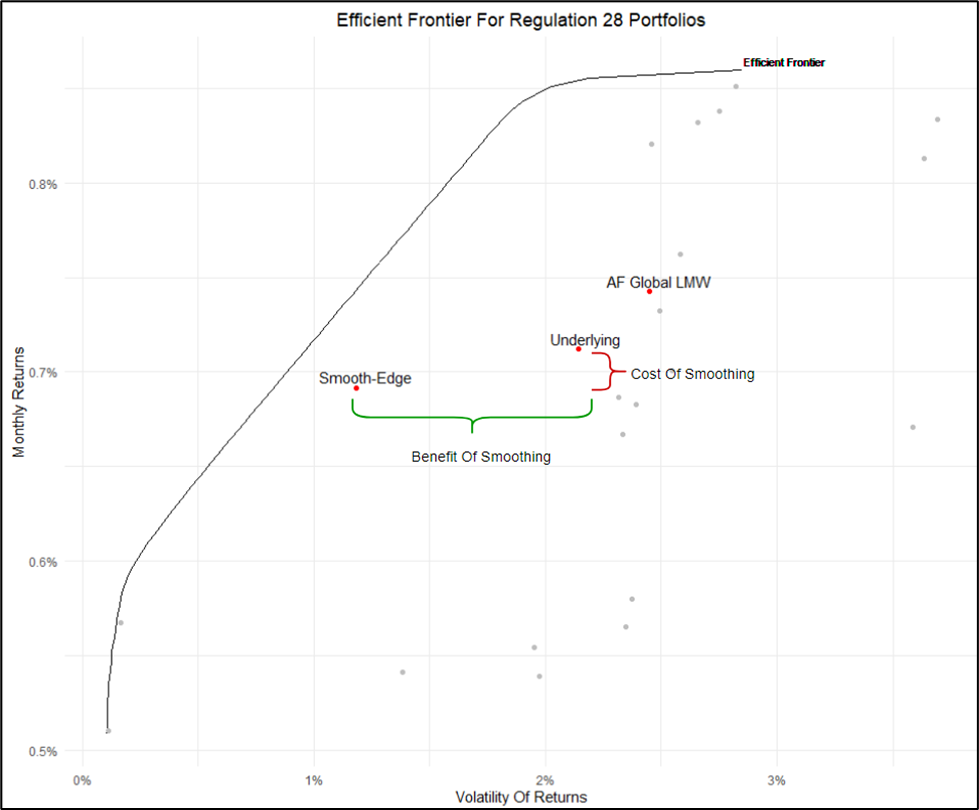

The efficient frontier refers to a set of optimal investment portfolios that offer the highest expected return for a defined level of risk (conversely the lowest risk for a given level of expected return). It is graphically represented as a curve on a graph, with the expected portfolio return on the y-axis and expected portfolio risk (as measured by volatility of returns) on the x-axis. Portfolios that lie below the efficient frontier are sub-optimal because they are deemed to not provide the maximum return for the level of risk assumed. Investment portfolios situated nearer to the frontier are deemed more efficient compared to those positioned further away from it.

The efficient frontier below was constructed by evaluating a broad spectrum of Regulation 28 portfolios offered by major asset management firms in South Africa, which are typically the options provided by retirement fund trustees. The analysis is based on the performance (gross of management fees, but net of any capital guarantee fees) over the past decade.

The cost of smoothing the returns and the guarantee is displayed on the vertical axis while the benefit of smoothing is shown on the horizontal axis. For the risk-averse investor, the peace of mind gained from reduced volatility can justify the associated costs of smoothing and the guarantee. This volatility reduction results in a positive shift for the Smooth-Edge Fund, bringing it closer to the efficient frontier, and has the effect of enhancing its value when evaluating it on a risk-adjusted basis.

Measuring Portfolio Efficiency

The Sharpe ratio is a financial metric that measures the risk-adjusted return of a portfolio. The higher the Sharpe ratio, the better, as it indicates a more favourable risk-adjusted return. Specifically, the Sharpe ratio quantifies the excess return an investment earns per unit of risk taken, where risk is defined as the standard deviation of the investment’s excess returns (relative to a risk-free asset). In simple terms, the Sharpe ratio helps investors assess whether the additional return earned from an investment is justified by the level of risk incurred.

For simplicity in the investment landscape, it is assumed that a diversified money market fund, barring credit risk, serves as the proxy for a risk-free asset. When calculating the Sharpe Ratio, two versions are introduced: the short-term Sharpe ratio using monthly returns for investors with short-term investment horizons or those sensitive to monthly fluctuations, and the long-term Sharpe ratio using yearly returns for investors with longer-term investment horizons or those not sensitive to monthly movements.

The Smooth-Edge Fund stands out with an impressive short-term Sharpe Ratio of 2.17, showcasing robust risk-adjusted performance over shorter timeframes. While the Long-Term Sharpe Ratio of 0.63 is somewhat lower, it still indicates a favourable risk-return trade-off over the long term.

The benchmark for corporate investment portfolios managed by major asset managers, the Alexander Forbes Global Large Manager Watch (GLMW) Median, exhibits Short-Term and Long-Term Sharpe Ratios lower than those of the Smooth-Edge Fund. This showcases the superior risk-adjusted returns and the value of smoothing that the Smooth-Edge Fund provides when compared to a well-known industry benchmark.

Bringing It Home

In summary, navigating the local and global investment landscape is a challenging and complex task, particularly for retirement fund members seeking the right balance between risk and reward. For risk-seeking investors with long investment horizons, the Smooth-Edge Fund or other similar smoothed bonus portfolios, may not be the most appropriate investment option, as it doesn’t maximize absolute returns. However, for risk-averse investors or for those approaching retirement, it offers superior risk-adjusted returns when compared to their market-linked alternatives. The growth exposure of the Smooth-Edge Fund allows risk-averse investors to enjoy inflation-beating investment returns, while protecting them from capital losses and reducing the volatility experienced in their retirement savings in their journey to retirement.

Disclaimer: This blog is for general information and education only. It does not constitute advice (financial or otherwise) and should not be relied upon as such. I am not licensed to provide financial advice. The content may contain errors or omissions and is provided without any guarantee of accuracy or completeness. No liability is accepted for any loss or damage arising from reliance on this content. For advice tailored to your circumstances, please consult a registered financial advisor.